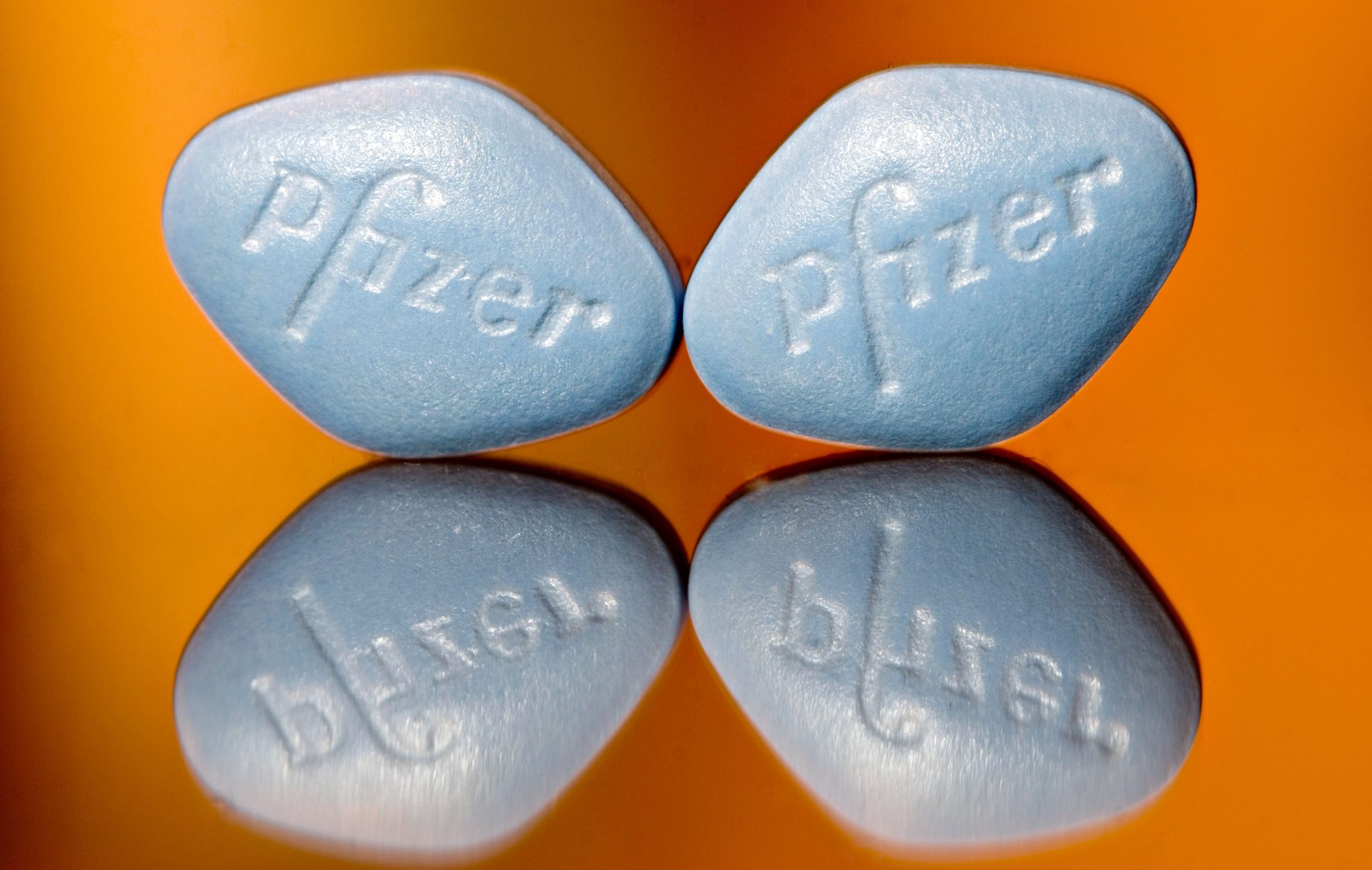

In 2008, Medicare beneficiaries looking for coverage of Viagra faced specific guidelines that shaped their access to this medication. Medicare Part D, which focuses on prescription drug benefits, did not universally cover erectile dysfunction medications such as Viagra.

To determine if Viagra was covered, beneficiaries needed to consult their individual Part D plan’s formulary. This list details which medications are covered and at what tier, which affects the overall cost. Some plans included Viagra on their formulary while others did not, making it essential for members to review their options carefully.

For those enrolled in a Medicare Advantage plan, the situation depended on the specific plan rules regarding drug coverage. Notably, some Medicare Advantage plans might have provided coverage for Viagra, often with different copayment structures.

Beneficiaries requiring Viagra should have worked closely with their healthcare providers to explore alternatives and ensure that their chosen plan met their medication needs. Using mail-order pharmacies or generic options, if available, could also provide more manageable costs. Always check annually for any changes in coverage, as formularies can be updated each plan year.

- 2008 Medicare Prescription Drug Viagra Coverage

- Understanding Medicare’s Role in Prescription Drug Coverage

- Types of Medicare Prescription Drug Plans

- Factors to Consider When Choosing a Plan

- Eligibility Criteria for Viagra Coverage Under Medicare

- Part D Plan Options for Covering Viagra in 2008

- Cost Implications of Viagra Coverage on Medicare Recipients

- Premiums and Deductibles

- Copayments and Coverage Gaps

- Process for Obtaining Viagra Through Medicare

- Comparing Medicare Drug Plans for Optimal Viagra Coverage

- Key Factors to Consider

- Using a Comparison Tool

- Frequently Asked Questions about Viagra and Medicare

- Can I get Viagra through a Medicare Part D plan?

- What should I do if my Medicare plan does not cover Viagra?

2008 Medicare Prescription Drug Viagra Coverage

The Medicare Part D program does not cover Viagra or similar medications for erectile dysfunction. However, beneficiaries may still have options. Many private prescription drug plans offer coverage for these medications, but specific benefits can vary significantly across plans.

If you require Viagra, consider discussing alternative medications or generics with your healthcare provider, as these may be covered by Medicare Part D. It’s also helpful to consult the formulary of your specific drug plan to understand your coverage options.

Additionally, some pharmaceutical companies provide assistance programs that can help reduce costs or provide discounts on Viagra. Checking eligibility for these programs can lead to significant savings.

Evaluate your options annually during the Open Enrollment Period. You may find a drug plan that better meets your needs in terms of coverage for erectile dysfunction medications. Comparing benefits across different plans ensures you make an informed decision that aligns with your health and financial situation.

Understanding Medicare’s Role in Prescription Drug Coverage

Medicare provides coverage for prescription drugs primarily through Part D. This part of Medicare helps reduce the out-of-pocket costs for medications that beneficiaries need for various health conditions. Choosing a Part D plan allows you to access affordable medications and ensure that your healthcare needs are met.

Types of Medicare Prescription Drug Plans

There are two main types of prescription drug coverage under Medicare:

- Standalone Part D Plans: These are separate plans that work alongside Original Medicare (Parts A and B). They cover only prescription drugs.

- Medicare Advantage Plans (Part C): Many of these plans include drug coverage integrated with health services, often offering additional benefits.

Factors to Consider When Choosing a Plan

Selecting the right plan involves several key factors:

- Formulary: Review each plan’s formulary, which lists the covered medications. Ensure that your necessary prescriptions are included.

- Costs: Check premiums, deductibles, and copayments. These costs can significantly vary between plans.

- Pharmacy Network: Confirm that your preferred pharmacy is in the plan’s network to avoid higher costs.

- Star Ratings: Look at the Medicare Star Ratings for quality and performance ratings of the plan.

Staying informed about the specifics of your Medicare plan enables you to utilize your prescription drug benefits effectively. Regularly review your coverage options, especially during the Open Enrollment Period, to adapt to changes in your medication needs or plan offerings.

Eligibility Criteria for Viagra Coverage Under Medicare

To qualify for Viagra coverage under Medicare, you must meet specific conditions. Currently, Medicare does not cover Viagra directly. However, coverage may be available under certain circumstances related to underlying medical conditions.

- Diagnosis of Erectile Dysfunction: A confirmed diagnosis of erectile dysfunction (ED) is essential. This may require documentation from a healthcare provider.

- Underlying Health Issues: Coverage might be considered if ED results from an underlying medical condition, such as diabetes or hypertension, both of which are commonly recognized by Medicare.

- Alternative Treatments: Before considering coverage for Viagra, providers may need to evaluate and document the failure of other treatments, like injections or vacuum devices.

- Medicare Part D: While original Medicare may not cover Viagra, you may find coverage through Medicare Part D plans, which often include prescription medications. Verify your specific plan’s formulary.

Consult with your healthcare provider for guidance on obtaining the necessary documentation and understanding the specific steps to take. Always verify your plan options for potential coverage and any copays that may apply.

Part D Plan Options for Covering Viagra in 2008

Review the specifics of Part D plans that include coverage for Viagra. Not all plans offer this benefit, so you’ll want to analyze each option carefully. Start by examining the formulary lists for various plans to identify those that cover erectile dysfunction medications. Some plans may include Viagra under different tiers, impacting your co-pays and overall costs.

Contact your current Part D provider to confirm whether Viagra is included in your plan. If it’s not covered, inquire about alternative plans that do. Consider switching plans if another option provides better coverage for Viagra at a lower cost.

Pay attention to any step therapy requirements some plans have in place. Certain insurers may request a trial of other medications before approving Viagra, which can add time and complexity to your treatment process.

To find the best choice for you, use the Medicare Plan Finder tool available at Medicare.gov. Enter your specific medications, including Viagra, to compare plans. This feature helps highlight which plans cover your prescriptions and any associated out-of-pocket costs.

Evaluate the total costs, not just the premium. Review deductibles, co-pays, and the coverage gap, also known as the “donut hole,” to understand your financial responsibility fully when obtaining Viagra.

Consider consulting with a licensed insurance agent specializing in Medicare to tailor a plan that meets your needs and budget. Agents can provide insights on lesser-known plans that may offer better coverage for erectile dysfunction medications.

Stay informed about any changes in coverage options as insurance plans can adjust their formularies annually. Regularly revisit your plan and others to ensure you maintain the best coverage for Viagra.

Cost Implications of Viagra Coverage on Medicare Recipients

Medicare recipients considering Viagra should be aware of several financial aspects. Coverage for erectile dysfunction medications, including Viagra, typically falls under Medicare Part D, which handles prescription drug costs. This means recipients must enroll in a Part D plan that includes Viagra on its formulary.

Premiums and Deductibles

The cost for Viagra largely depends on the specific Part D plan selected. Most plans require a monthly premium, along with a deductible that may vary from one plan to another. Expect premiums to range from $15 to $100 monthly, depending on the plan’s coverage level and formulary. Be mindful of any out-of-pocket expenses you might incur before reaching the deductible, which could be up to $500.

Copayments and Coverage Gaps

Once the deductible is met, copayments for Viagra can range from $10 to $50 per prescription, depending on the plan. Recipients should also consider the coverage gap, or “donut hole,” which occurs when total drug costs exceed a certain threshold. During this period, individuals may pay a larger percentage of the medication’s cost until they reach the catastrophic coverage limit. Understanding these specifics will help manage your overall expenses effectively.

Process for Obtaining Viagra Through Medicare

To obtain Viagra through Medicare, first confirm your eligibility and ensure that your Medicare plan offers prescription drug coverage (Part D). Not all plans include coverage for erectile dysfunction medications, so check your specific plan details.

Visit your healthcare provider to discuss your symptoms and the potential need for Viagra. If your provider determines that Viagra is appropriate for your condition, they will write a prescription. It’s important to communicate openly with your provider about your medical history and current medications.

Once you have your prescription, contact your Medicare Part D plan to verify coverage for Viagra. Ask about any restrictions, such as prior authorization requirements or whether a generic version is available. Understanding your plan’s rules can help avoid surprises at the pharmacy.

Finally, take your prescription to an in-network pharmacy for processing. Present your Medicare card along with the prescription. Confirm the out-of-pocket cost before finalizing your purchase, as costs may vary based on your plan.

Keep all receipts and documentation for your records, and review your coverage annually during open enrollment to ensure it continues to meet your needs.

Comparing Medicare Drug Plans for Optimal Viagra Coverage

Select a Medicare Part D plan that specifically includes Viagra coverage for better financial management. Viagra, or sildenafil, is often covered under certain plans, but it’s crucial to review the formulary carefully, as not all plans offer the same benefits.

Key Factors to Consider

Check the list of covered medications to confirm Viagra is included. Additionally, assess the tier level assigned to Viagra since this affects your copayment. Lower tier levels usually have lower costs. Look for plans that have affordable premiums and deductibles.

Using a Comparison Tool

Employ Medicare’s online Plan Finder tool to compare different plans side by side. Input your medications to see the coverage options, estimated costs, and any restrictions, such as prior authorization. Focus on plans with favorable reviews from other users regarding their prescription drug coverage.

| Plan Name | Monthly Premium | Deductible | Copayment for Viagra |

|---|---|---|---|

| Plan A | $30 | $200 | $10 |

| Plan B | $25 | $150 | $15 |

| Plan C | $35 | $250 | No coverage |

Confirm any caps on the number of pills covered per month to avoid unexpected expenses. Additionally, call the plan provider to double-check details, as changes might not always be reflected online. By assessing these factors, you can select a plan that provides the best value for Viagra coverage and enhances your financial well-being.

Frequently Asked Questions about Viagra and Medicare

Medicare generally does not cover Viagra. However, if impotence is a result of a medical condition covered by Medicare, such as post-prostate surgery, there may be some circumstances where coverage is possible. Consult your physician for a detailed evaluation and appropriate documentation.

Can I get Viagra through a Medicare Part D plan?

Some Medicare Part D plans may cover Viagra and similar medications, but this varies by plan. It’s crucial to check your specific plan details. Contact your plan provider for a list of covered medications and any associated co-pays or restrictions.

What should I do if my Medicare plan does not cover Viagra?

If your current Medicare plan does not cover Viagra, consider appealing the decision. Provide your doctor’s notes to support your case. Alternatively, explore other options, such as discount programs or generic versions, to help manage costs effectively.